If you follow the money year over year, you’ll see this isn’t bad luck – it’s a trend. And trends are deliberate.

Operating Fund – The Controlled Dive

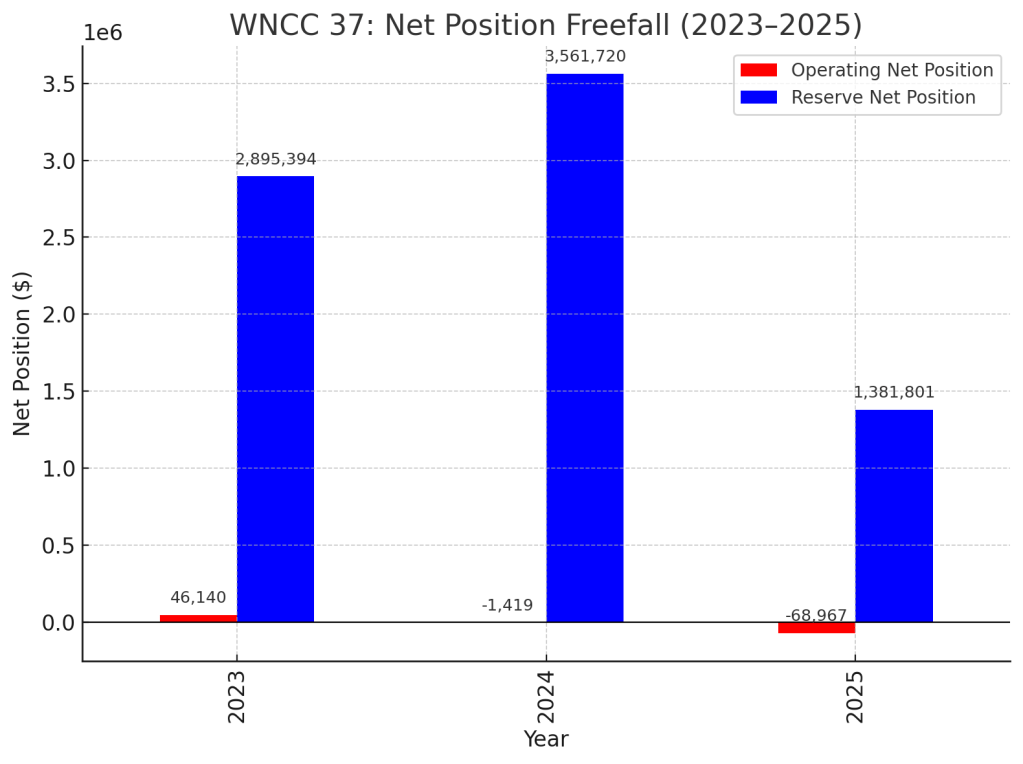

- 2023: $46,140 surplus. Liabilities were manageable at $86K, and the bank account actually had cash in it.

- 2024: $1,419 deficit. The cushion vanished. Liabilities jumped by $47,921 in a single year (from $86K to $133,977). The bank balance improved briefly, but that was likely borrowed time, not new revenue.

- 2025: $68,967 deficit. Liabilities ballooned to $158,128, while total assets collapsed from $132K to $89K. Bank account now sits at –$35,497 (yes, negative), and the fund owes the reserve $67,068.

Pattern: In just two years, they burned through the surplus, ate into the cash, maxed out the liabilities, and started borrowing from reserves – while still prepaying $25,511 to lawyers.

Reserve Fund – The Big Hit

- 2023: $2.90M net position – stable, large capital reserve, exactly what’s supposed to be there.

- 2024: $3.56M net position – up by $651K from the year before. Could be due to special assessments, investment returns, or deferred projects. On paper, the reserve looked bulletproof.

- 2025: $1.38M net position – a drop of $2.18M in one year. This isn’t a maintenance draw. This is a major capital outlay or reallocation – the kind that should have been clearly explained to owners. And remember, $67K of that is already tied up in an IOU to the operating fund.

Pattern: Reserves inflated, then drained. The timing suggests 2024 was used to bulk up the account – and 2025 to spend it down fast.

The Legal Retainer – A Standing War Chest

The $25,511.61 prepaid legal retainer in 2025 sticks out like a sore thumb. It’s not part of the reserve, it’s not an operational necessity – it’s a pre-authorized legal fund, parked and ready to deploy.

You don’t hold that kind of money with lawyers when your operating fund is bleeding – unless you know you’ll be losing.

What the Charts Show

- The red bars (operating fund net position) in the chart drop from +$46K in 2023 to –$69K in 2025 – that’s a $115K swing in two years.

- The blue bars (reserve fund) hold steady and even grow… until they crash, losing 61% of value in one year.

Translation for Owners

This isn’t just “costs going up.” This is a structural financial shift:

- Operations moved from surplus to debt.

- Reserves were bulked up and then drained.

- Legal spending was insulated from the cuts.

The building’s finances aren’t drifting – they’re being steered.

Disclaimer:

The financial figures in this post are taken directly from the official records of WNCC No. 37, obtained under the rights granted to owners by Section 55 of the Ontario Condominium Act, 1998. These figures are presented exactly as recorded in the corporation’s financial statements and balance sheets. No personal owner information has been included. Analysis and commentary are the author’s, based solely on the publicly accessible corporate financial data.