Who Does What, and Why It Matters to Your Money

A condominium board is not a casual volunteer club.

Board members make decisions about millions of dollars, set the financial strategy for the corporation, and directly impact our property values and condo fees.

But many owners don’t actually know what each role does – or should be doing.

Here’s a clear breakdown.

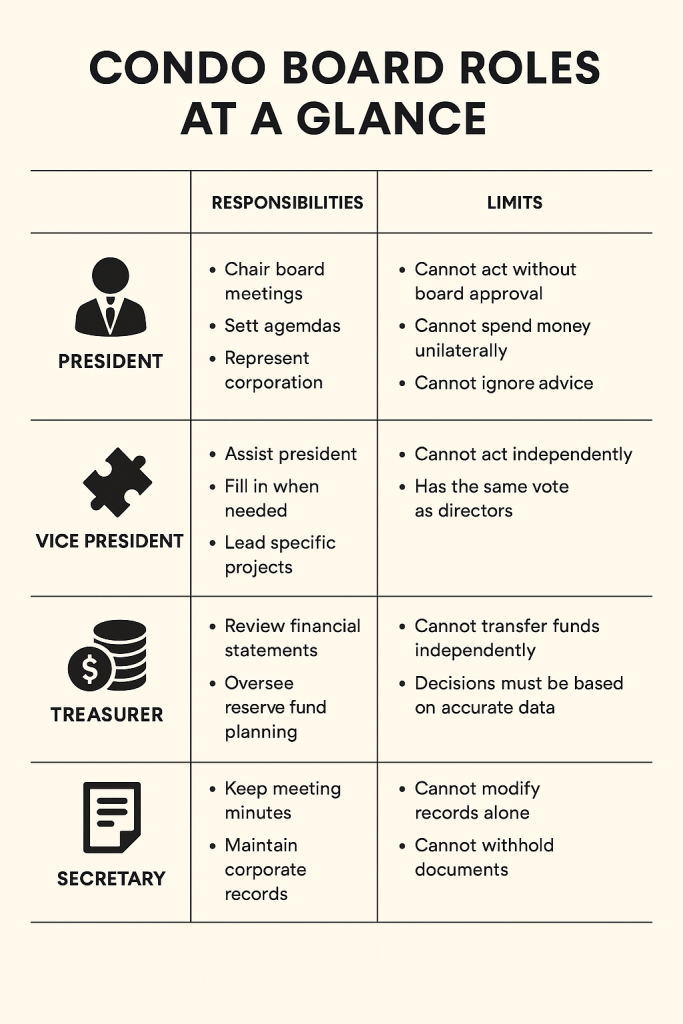

👔 1. President – The Facilitator, Not the Boss

The president leads the board but doesn’t control it.

They are one vote among equals – not a CEO, not an autocrat, and definitely not the owner of the corporation.

Responsibilities:

- Chairing board meetings and keeping discussions productive

- Setting meeting agendas with input from the property manager and other directors

- Ensuring decisions are based on facts, reports, and expert advice

- Representing the corporation in dealings with lawyers, engineers, insurers, and contractors

- Promoting transparency and timely communication with owners

Limits:

- Cannot make decisions alone without board approval

- Cannot spend corporation money unilaterally

- Cannot hide information or bypass engineering/financial advice

A good president focuses on leadership and consensus, not control and shortcuts.

🧩 2. Vice President – The Support and Backup

The vice president acts as the second-in-command and supports the president, stepping in when needed.

Responsibilities:

- Assisting the president with daily governance tasks

- Filling in when the president is unavailable

- Leading specific committees or projects assigned by the board

- Helping manage relationships with contractors and the property manager

- Ensuring continuity if leadership transitions are needed

Limits:

- Cannot act independently unless formally authorized by the board

- Shares the same voting power as any other director

A good VP strengthens leadership, ensures smooth operations, and keeps the board functioning efficiently.

💰 3. Treasurer – The Financial Steward

The treasurer is the guardian of the corporation’s money and plays one of the most critical roles on the board.

This position requires financial literacy, attention to detail, and strategic thinking.

Responsibilities:

- Reviewing and approving financial statements, budgets, and forecasts

- Overseeing reserve fund planning and ensuring funds are used appropriately

- Working closely with accountants, auditors, and engineers

- Making sure payments, invoices, and financial reports are accurate and transparent

- Identifying financial risks early and proposing solutions

Limits:

- Cannot spend or transfer corporation funds without board approval

- Must base decisions on accurate data, not assumptions or “gut feelings”

A good treasurer protects owners’ investments, keeps fees stable, and ensures long-term financial sustainability.

📝 4. Secretary – The Record Keeper and Compliance Gatekeeper

The secretary ensures the corporation stays organized, compliant, and transparent.

Responsibilities:

- Keeping accurate meeting minutes and corporate records

- Handling official correspondence on behalf of the board

- Ensuring the corporation complies with the Condominium Act and other regulations

- Coordinating owner communications and notices

- Maintaining a clear paper trail for all board decisions

Limits:

- Cannot modify records without board approval

- Cannot withhold legally accessible documents from owners

A good secretary ensures accountability, transparency, and compliance at every step.

⚖️ Why This Matters to Owners

The roles on a condo board are not ceremonial titles.

When these positions are filled by people who lack the skills, experience, or judgment, the results are:

- Poor financial planning

- Skyrocketing fees and special assessments

- Ignored engineering advice

- Drained reserve funds

- Legal risks and unnecessary litigation costs

But when the right people fill these roles, the benefits are clear:

- Lower risk of financial surprises

- Better long-term planning

- Transparent communication with owners

- Competent management of millions in collective funds

Bottom Line

A well-functioning condo board isn’t about who has free time or handyman skills.

It’s about electing people who:

- Understand budgets and forecasts

- Can read and act on expert advice

- Know how to negotiate, influence, and collaborate

- Put owners’ financial interests first

When the right people lead, everyone wins – lower fees, stronger reserves, and better property values.